Meets the requirements of the Swedish Tax Agency

Reducing administration

Saves time and money

Built-in driver identification

Simple installation

An automated travel log saves you time and effort, freeing up resources for other important tasks.

With our electronic travel log, you are guaranteed a more efficient workday and tax management. Accurate documentation of mileage, which is crucial for the Tax Agency’s audits, reduces the risk of incorrect tax calculations and fines.

You will also gain a detailed insight into vehicle use, which can help you identify areas for fuel savings and increased cost efficiency. Through real-time tracking, compliant with GDPR and current data protection regulations, enables more efficient management of your fleet.

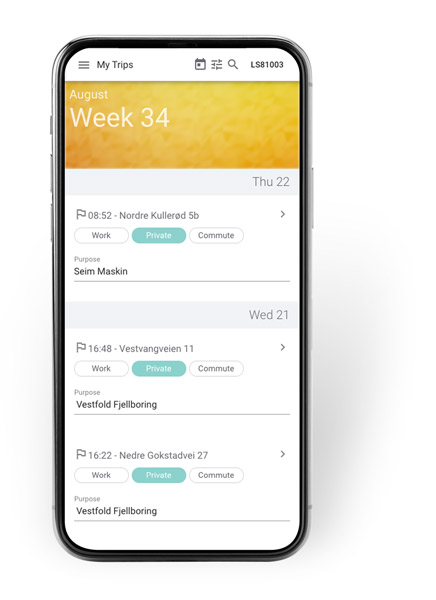

The travel log also has built-in driver identification designed for ease of use. All drivers can easily adjust their trips directly on their mobile phone to calculate mileage reimbursement for travel to and from work.

“

Travel log

Allows fleet managers to administer active drivers and review and classify trips to comply with regulatory tax guidelines.